Unlocking Growth: How African SMEs Can Leverage the Debt Capital Market as an Alternative to Bank Loans

Unlocking Growth: How African SMEs Can Leverage the Debt Capital Market as an Alternative to Bank Loans

Introduction

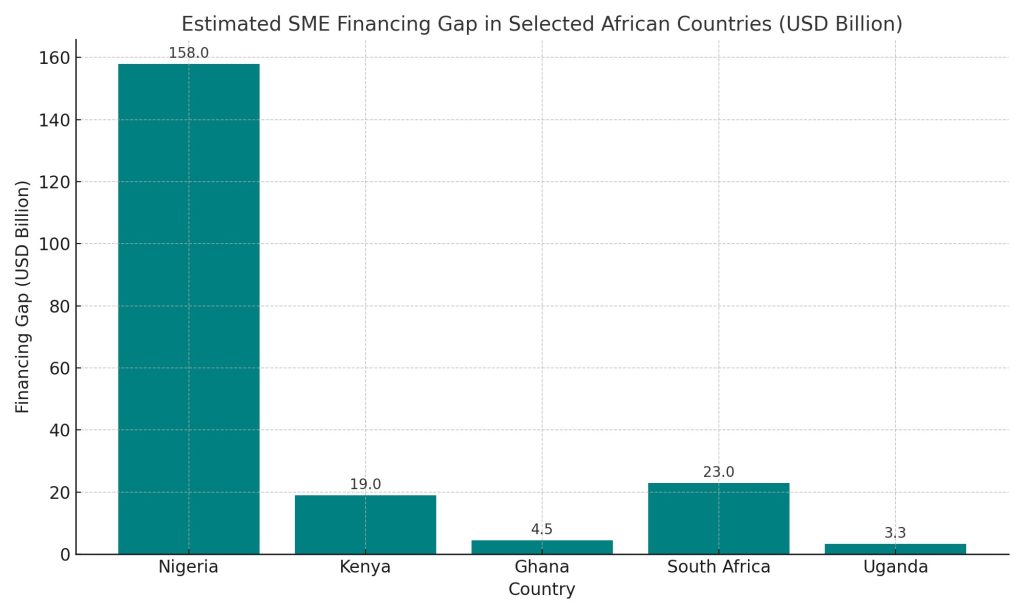

Small and Medium Enterprises (SMEs) form the backbone of Africa’s economy, accounting for over 90% of businesses and 60% of employment across the continent. Despite this, SMEs face a massive financing gap estimated at over $330 billion, according to the International Finance Corporation (IFC). Traditional bank loans remain difficult to access due to high interest rates, collateral demands, and stringent credit assessments. Amidst these challenges, the Debt Capital Market (DCM) is emerging as a viable, scalable, and long-term alternative. This article explores how SMEs in Africa can harness the DCM to meet their financing needs and scale sustainably.

What Is the Debt Capital Market?

The Debt Capital Market enables entities to raise funds through bonds, notes, and commercial papers from investors, offering fixed returns over a defined period. Unlike bank loans, these instruments can be structured with flexible repayment terms and lower long-term costs, while preserving business ownership.

The SME Financing Gap: A Snapshot

Below is a visual representation of the estimated SME financing gap in selected African countries:

Source: Adapted from SME Finance Forum, World Bank/IFC estimates.

Why SMEs Should Consider the Debt Capital Market

- Diversified and Reliable Capital – Issuing bonds or notes can help SMEs reduce their dependence on banks. The DCM provides access to a broader pool of investors, including pension funds, insurance companies, impact investors, and DFIs.

- Longer Tenor and Predictable Repayment – DCM instruments often offer maturities of 3–7 years or more, allowing SMEs to invest in long-term projects without short-term repayment pressure.

- Competitive Cost of Capital – While upfront issuance costs may be higher, interest rates on SME bonds can be lower than bank lending rates in the long run, especially for well-rated entities.

- Enhanced Governance and Market Credibility – Being part of a formal capital market encourages improved corporate governance, transparency, and investor trust—often translating into future capital access at better terms.

Case Studies and Market Developments

📍 Nigeria – FMDQ Private Markets: Through its private market platform, FMDQ has facilitated over ₦60 billion in commercial paper and corporate note issuances by SMEs in agriculture, healthcare, and manufacturing.

📍 Ghana – Ghana Alternative Exchange (GAX): GAX offers a simplified bond issuance process for SMEs, with several mid-sized firms successfully raising funds for expansion since 2015.

📍 Kenya – Capital Markets Authority (CMA): Kenya’s CMA has approved green bonds and structured SME bond vehicles, targeting impact-driven enterprises in agriculture, clean energy, and infrastructure.

Key Challenges Facing SMEs

- High Issuance Costs – Legal, administrative, and listing fees can be prohibitive.

- Lack of Credit Ratings – Many SMEs lack formal financial reporting or credit history.

- Investor Scepticism – Concerns about default risk, liquidity, and transparency.

- Low Financial Literacy – SMEs may not fully understand DCM mechanics or requirements.

How African SMEs Can Access the Debt Market

✅ Formalise and Audit Your Financials – Sound financial reporting and auditing improve investor confidence and ease due diligence.

✅ Seek Credit Ratings – Partner with local or regional rating agencies to obtain an independent risk assessment.

✅ Consider Issuing Commercial Papers – For short-term needs, SMEs can issue commercial papers, now accepted by institutional investors in many countries.

✅ Explore Aggregated Issuance – SMEs can form cooperatives or SPVs to jointly issue bonds, reducing transaction costs and spreading risk.

✅ Tap Development Finance Support – Leverage DFI-backed guarantees and technical assistance for de-risking investments.

Policy Recommendations

- Simplify regulations for mini-bond issuances.

- Subsidise ratings and advisory costs for eligible SMEs.

- Establish SME-focused bond boards or private placement platforms.

- Improve market liquidity and investor education.

Conclusion

African SMEs are rich in potential but constrained by capital access. The debt capital market presents an untapped opportunity for long-term, affordable, and scalable financing. With supportive regulatory environments, strategic partnerships, and better financial transparency, SMEs can transition from bank-dependent borrowers to credible market-based issuers, driving inclusive economic growth across Africa.

Want to know if your SME is ready to issue a bond or commercial paper? Contact us for a free assessment or subscribe to our newsletter for regular insights.