Financing Africa from Within: Pathways Beyond Foreign Aid Dependence

How Africa Can Generate Funding Internally in the Absence of Foreign Aid from Multilateral Organisations

As multilateral aid from the West and Asia becomes increasingly unreliable due to shifting global geopolitics, rising populism, and donor fatigue, African countries face an urgent imperative: to generate sustainable development funding from within. This article presents a comprehensive framework on how Africa can mobilise internal resources to finance infrastructure, social services, and economic transformation, while presenting statistical evidence and visual insights.

Domestic Resource Mobilisation (DRM): Africa’s Untapped Potential

Domestic Resource Mobilisation refers to the generation of government revenue from internal sources, particularly through taxes and levies. Despite being the most sustainable source of financing, Africa underperforms in this area.

Key Facts:

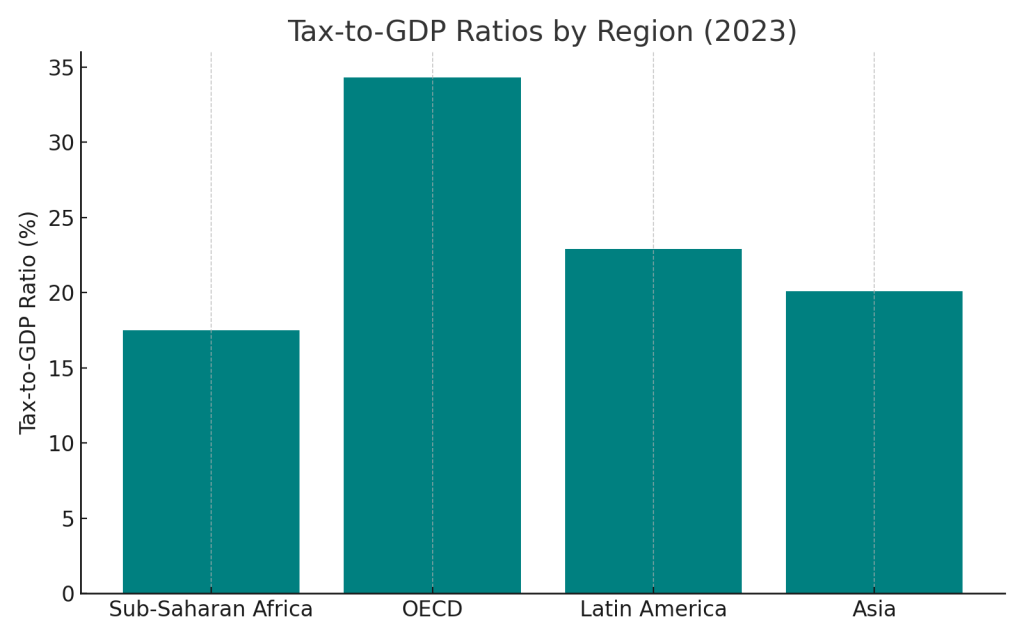

- Sub-Saharan Africa’s average tax-to-GDP ratio was 17.5% in 2023, far below the OECD average of over 34%.

- Only 15 African countries exceed the 20% threshold necessary to fund basic public services (IMF, 2024).

Strategies for Improvement:

- Broadening the Tax Base: By formalising the informal sector, which accounts for 85% of employment in Africa.

- Improving Tax Compliance: Leveraging digital tools and data analytics to reduce tax evasion.

- Modernising Tax Systems: Through electronic filing, simplified VAT structures, and automation.

Chart: Tax-to-GDP Ratios in Africa vs Other Regions (2023)

Source: OECD’s Revenue Statistics

Tackling Illicit Financial Flows (IFFs)

Illicit financial flows are a major drain on African economies, with capital illegally transferred across borders.

Facts:

- Africa loses an estimated $88.6 billion annually to IFFs (UNCTAD, 2022).

- Nigeria alone lost over $15 billion to IFFs in 2023.

Recommendations:

- Strengthen legal frameworks and cross-border collaboration.

- Empower Financial Intelligence Units (FIUs).

- Demand greater transparency from multinationals.

Deepening Domestic Capital Markets

Africa’s bond and equity markets remain shallow, yet they offer a promising source of long-term funding.

Opportunities:

- Local Currency Bonds: Reduces exchange rate risk and promotes investor confidence.

- Infrastructure Bonds: Mobilising pension and insurance funds into public works.

Example:

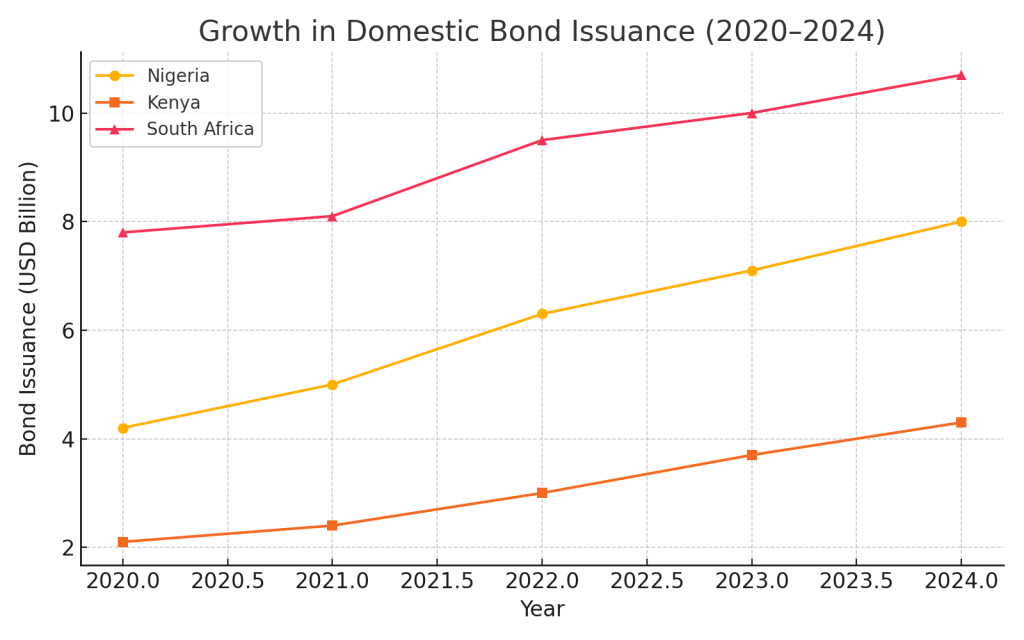

- In 2024, South Africa’s All Bond Index delivered a 17% return, showcasing the strength of domestic markets.

Graph: Growth in Domestic Bond Issuance in Select African Countries (2020-2024)

Source: Data aggregated from national Debt Management Offices and regional capital market reports.

Mobilising Institutional Investors and Pension Funds

Pension funds represent a largely untapped source of patient capital for infrastructure development.

Data Points:

- African pension assets exceed $750 billion.

- A mere 2.5% reallocation toward infrastructure could unlock over $20 billion annually.

Policy Suggestions:

- Encourage public-private partnerships (PPPs).

- Implement regulatory reforms to allow infrastructure investment.

Financial Technology (FinTech) as a Funding Catalyst

FinTech is revolutionising access to finance in Africa, especially for the unbanked population.

Impact:

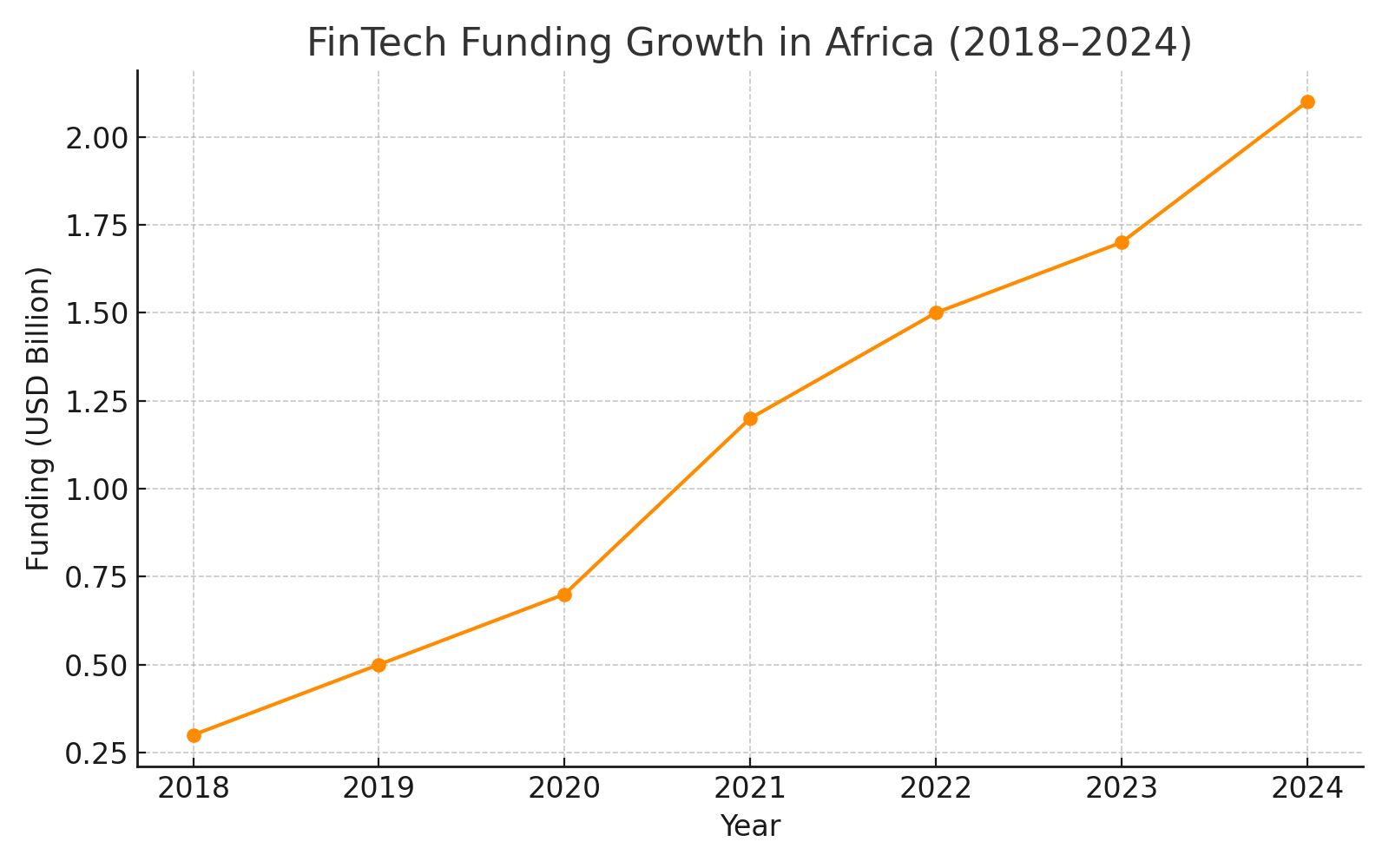

- FinTech investments in Africa hit $1.5 billion in 2022.

- Mobile money transactions exceeded $800 billion in 2023, driven by platforms like M-Pesa and Flutterwave.

Solutions:

- Expand digital identity systems for KYC.

- Encourage savings and investment apps.

- Create credit bureaus using alternative data.

Chart: FinTech Funding Growth in Africa (2018–2024)

Source: Partech Africa Tech Venture Capital Report 2024 & Tracxn & FinTech Africa Feed Report (2018–2023)

Leveraging Climate Finance & Green Bonds

Africa is uniquely positioned to tap into global climate finance mechanisms.

Statistics:

- Africa attracted $43.7 billion in climate finance in 2022, a 48% YoY increase.

- Kenya and Morocco issued green bonds worth $1.2 billion combined in 2023.

Action Plan:

- Develop bankable climate projects.

- Build national green finance frameworks.

Promoting Regional Trade and Currency Integration

Intra-African trade, currently at 14.4% of total trade, offers a vast opportunity to generate income and reduce dependence on external markets.

Policy Proposals:

- Accelerate the African Continental Free Trade Area (AfCFTA).

- Establish regional payment systems to reduce dollar dependency.

- Promote value-added manufacturing across borders.

Strengthening Governance and Accountability

Without good governance, mobilised funds are prone to waste or misappropriation.

Priorities:

- Transparent procurement processes.

- Real-time budget tracking and publication.

- Independent audit institutions.

Conclusion: Africa’s Self-Funding Future is Feasible

Africa has the tools to fund its development internally. By boosting domestic revenue, deepening capital markets, tapping into institutional funds, embracing FinTech, and improving governance, the continent can reduce its dependence on foreign aid and build a resilient economic future.

Call to Action: African governments must act urgently and collaboratively to unlock internal funding mechanisms. Civil society, the private sector, and global partners have a role in creating a thriving, self-sufficient Africa.