Angola’s New Horizon: Beyond the Barrel.

Angola’s accommodating business policies, combined with its abundant natural resources, notably oil and diamonds, have positioned it as a top investment and trade destination in Africa. Recent substantial reforms aimed at economic diversification are unlocking further potential for foreign direct investment (FDI).

Macroeconomic Indicators

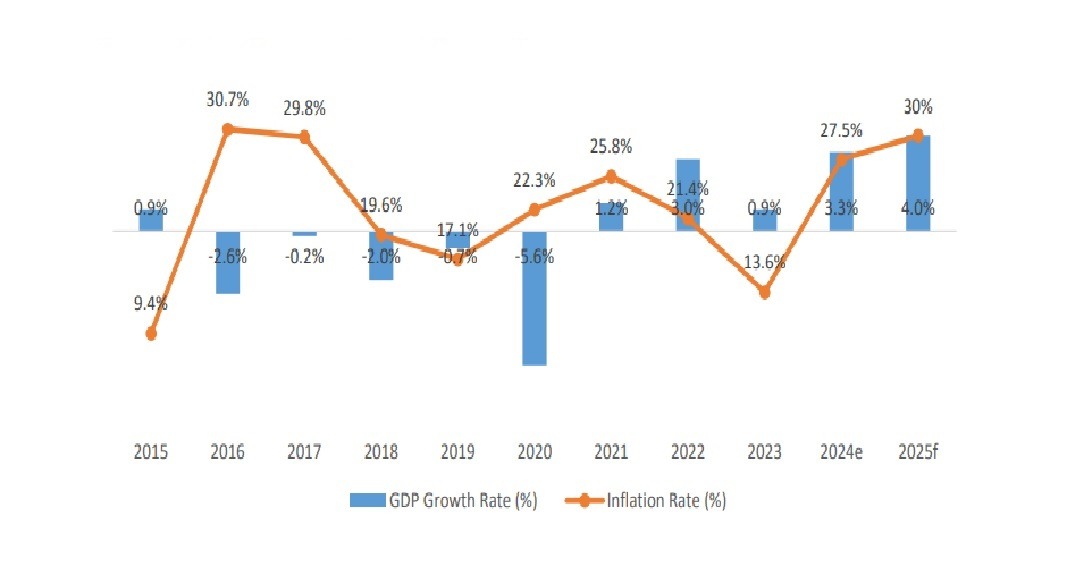

Reflecting its strong dependence on oil exports, Angola’s economic performance fluctuates with global oil prices. In 2023, declining oil production and prices resulted in a 0.9% GDP growth. Projections for 2024, however, indicate a significant rebound to 3.2%, fueled by an anticipated recovery in oil production and robust growth within the services sector.

Inflation remains a critical economic challenge in Angola. Although it showed improvement in 2023, decreasing to 13.6%, a significant surge to 27.5% occurred in 2024. Forecasts predict continued inflationary pressures into 2025, largely attributed to currency devaluation and fuel subsidy modifications.

Angola’s foreign exchange rate has been subject to considerable volatility, with a notable depreciation of the kwanza in 2023. To counteract this, and to control rising inflation, the National Bank of Angola raised the basic interest rate to 19% in March 2024. However, the kwanza further depreciated by 10% in 2024, with projections indicating a more stable currency outlook for 2025.

Figure 1. Angola’s GDP growth rate and Inflation (2015-2025)

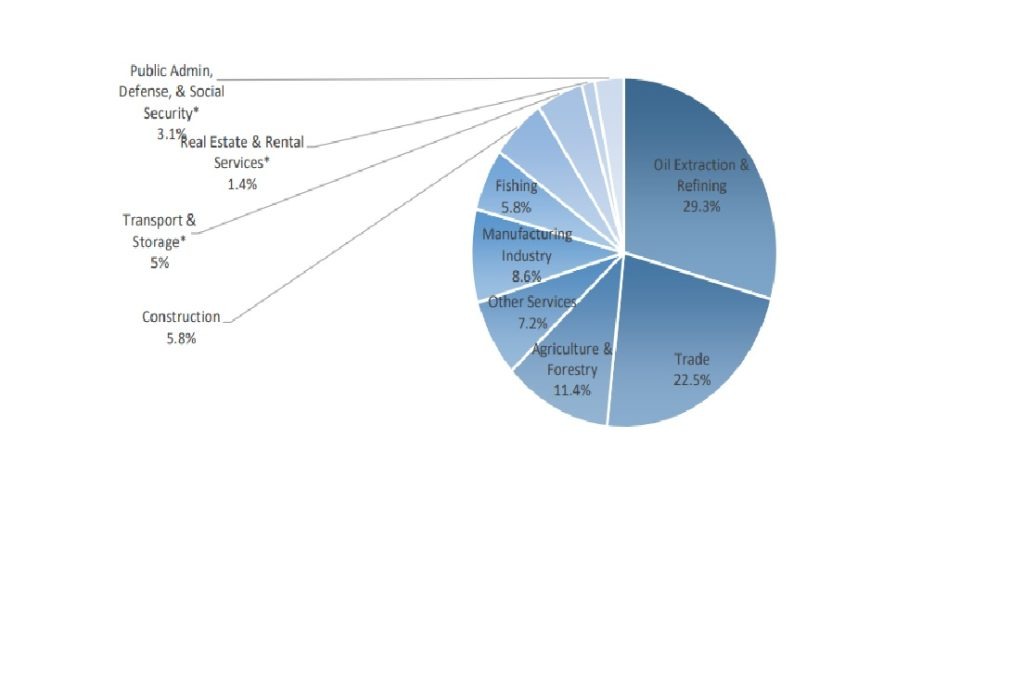

Figure 2. Angola’s GDP breakdown by Sector (2024)

Figure 2. Angola’s GDP breakdown by Sector (2024)

* estimated.

Fiscal Policies

Angola’s fiscal policy has focused on consolidation and reducing public debt. The draft budget for 2025 projects a fiscal deficit of 1.65% of GDP, slightly higher than the 1.46% expected for 2024. This budget assumes an oil price of $70 per barrel, reflecting cautious optimism in revenue projections.

Public debt remains a concern, with the debt-to-GDP ratio rising to 84% at the end of 2023, up from 69.2% in 2022. However, debt repayments are projected to decline, opening up more fiscal space for development expenditures. The government is also gradually phasing out fuel subsidies, which have constituted a significant portion of public expenditure. This move aims to reallocate resources towards social programs and infrastructure development.

Foreign Direct Investment (FDI) Landscape

Angola’s economy has been heavily reliant on its oil sector, shaping its FDI landscape. Despite government initiatives to diversify into agriculture, fisheries, and manufacturing, these sectors remain largely underdeveloped. Consequently, the oil industry continues to attract the majority of foreign investment. The Oil & Gas Journal estimates Angola’s proven crude oil reserves at 2.6 billion barrels as of early 2025, highlighting the sector’s continued significance.

In recent years, Angola has implemented reforms to improve its business environment, including simplifying business registration processes and enhancing legal frameworks to protect investors. These measures aim to increase transparency and reduce bureaucratic hurdles, thereby fostering a more conducive climate for FDI.

Key initiatives include:

Genexus’ Opinion

As asset managers, venture capitalists, and international investors increasingly prioritize strategic capital deployment and seek enhanced returns, Angola remains a compelling investment destination. The following sectors offer particularly favorable opportunities, barring unforeseen circumstances.

Agriculture and Agribusiness: With vast arable land and favorable climatic conditions, Angola presents significant agricultural opportunities. The government’s focus on reducing food imports and achieving self-sufficiency has led to incentives for investments in crop production, livestock, and agro-processing industries.

Infrastructure Development: The demand for robust infrastructure in Angola creates substantial prospects across transportation, energy, and telecommunications sectors. A key initiative is the U.S.-supported Lobito Corridor project, a $10 billion investment in rail infrastructure designed to enhance transport links from the Democratic Republic of Congo to the Atlantic coast, thereby stimulating mineral exports and regional commerce. This project offers considerable opportunities for engineering and construction companies. Furthermore, fintech and startups with solutions addressing essential social needs can exploit the existing infrastructure gaps within Angola.

Renewable Energy: Angola’s commitment to diversifying its energy mix and reducing carbon emissions has opened avenues in renewable energy projects, particularly in hydroelectric, solar, and wind power generation.

Tourism: Rich cultural heritage and natural beauty position Angola as a potential tourism hub. Investments in hospitality, ecotourism, and related infrastructure can tap into this underdeveloped sector.

While recognizing the potential obstacles, we are committed to actively resolving any challenges faced by investors pursuing opportunities in Angola.

Challenges includes;

Bureaucratic obstacles: Complex regulations and difficulties with permits and visas.

Currency volatility: Risks from kwanza depreciation and profit repatriation issues.

Infrastructure gaps: Poor transportation and unreliable utilities.

High operating costs: Expensive real estate, fuel, and inflation.

Legal system weaknesses: Slow dispute resolution and enforcement concerns.

Economic instability: Dependence on oil and potential political risks.

Limited financing: High interest rates and underdeveloped capital markets.

Skilled labor shortage: Lack of qualified professionals and language barriers.

Security and corruption: Persistent corruption and regional security concerns.

Genexus is prepared to partner with and provide extensive support to investors interested in participating in Angola’s future growth.