Africa’s Green Finance Revolution: Opportunities for Emerging Businesses

How Green Bonds Can Lift Emerging Businesses in Africa

How Green Bonds Can Lift Emerging Businesses in Africa and Shape the Future of Financing

Introduction

Africa stands at a crucial crossroads of development and climate resilience. With an expanding population, rapid urbanisation, and increasing climate risks, the continent must seek innovative financial instruments to fund sustainable growth. One such instrument is the green bond. While still nascent compared to global markets, green bonds hold transformative potential for emerging businesses across Africa. These instruments can catalyse capital flows into sectors like clean energy, climate-smart agriculture, waste management, and sustainable infrastructure.

Understanding Green Bonds

Green bonds are fixed-income securities issued to finance projects that have positive environmental or climate benefits. The proceeds are exclusively used for green projects, ranging from renewable energy and pollution prevention to clean transportation and water conservation. They operate like conventional bonds but are earmarked for environmentally beneficial initiatives, often attracting investors with sustainability mandates.

Africa’s Position in the Global Green Bond Market

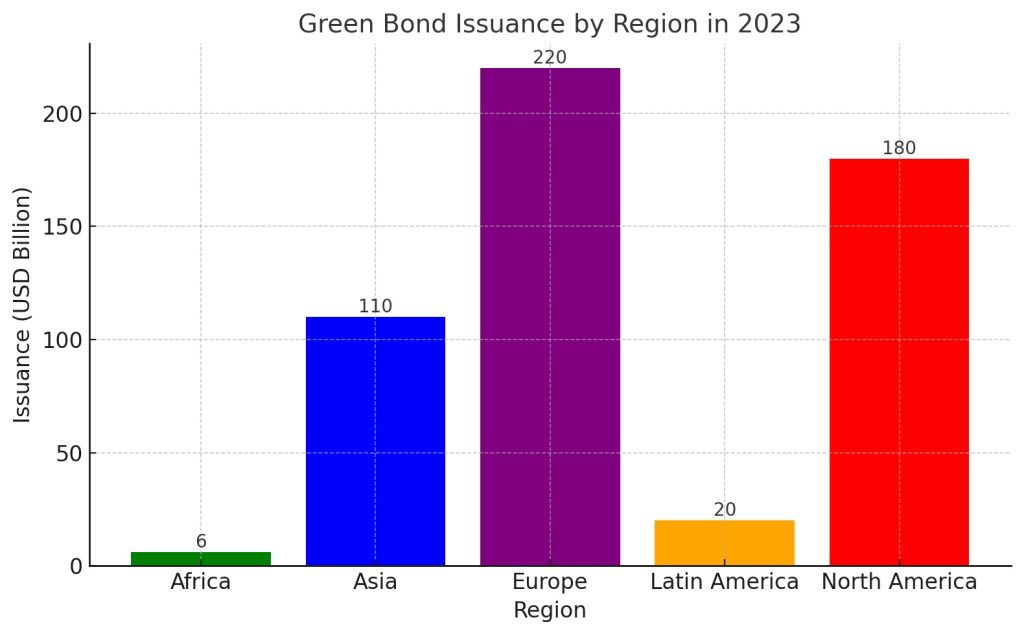

According to the Climate Bonds Initiative, global green bond issuance exceeded $550 billion in 2023. However, Africa accounted for only $6 billion of that total. Comparatively, Asia issued over $110 billion and Europe more than $220 billion, highlighting a significant gap and a massive opportunity.

Figure 1: Green Bond Issuance by Region in 2023

Source: The Climate Bonds Initiative Global State of the Market Report (2023)

The relatively nascent adoption of green finance instruments across Africa stems from a confluence of challenges, including limited awareness, fragmented regulatory landscapes, and underdeveloped capital markets. Despite these hurdles, the continent presents an immense and largely untapped potential for sustainable investment.

A testament to this potential, Nigeria emerged as a trailblazer, issuing Africa’s first sovereign green bond in 2017, which successfully raised ₦10.69 billion (approximately $30 million). This landmark issuance has since inspired a growing number of African nations and corporations to embrace the green finance movement. Among financial institutions, Access Bank Plc stands out, having pioneered Africa’s first Climate Bonds Standard fully certified corporate Green Bond in 2019, further demonstrating the private sector’s commitment to sustainable development.

Opportunities for Emerging Businesses

Access to Long-Term and Affordable Financing: Green bonds typically offer more favourable terms compared to traditional bank loans. They provide SMEs and startups with long-term capital essential for scaling environmentally aligned operations.

Boosting Credibility and Market Access: Participating in the green bond ecosystem helps businesses enhance their reputation among investors and regulators. This can lead to increased access to other forms of capital.

Tapping into Global Investor Appetite: ESG (Environmental, Social, and Governance) investing has become a major theme in global capital markets. African businesses with sustainable models can use green bonds to attract foreign capital from pension funds, development finance institutions, and impact investors.

Fostering Innovation: The green bond framework encourages companies to develop products and services that contribute to environmental goals. This innovation can lead to new market segments and job creation.

Key Sectors Poised for Green Bond Impact

Renewable Energy: Green bonds offer a crucial financing mechanism for scaling solar and wind projects, particularly for installations in rural and peri-urban communities. This is especially pertinent as the region has witnessed a significant surge in green energy trading activities. This heightened demand for solar energy is directly attributed to the increasing popularity of decentralised power solutions, driven by the persistent unreliability and epileptic nature of conventional electricity supply from central grids.

Climate-Smart Agriculture: Green bonds offer significant potential for financing sustainable irrigation systems, the adoption of organic inputs, and the development of modern agro-processing technologies. The demand for such investments is projected to grow substantially, driven by persistent food security challenges and the critical impact of food inflation across many African economies. Given Africa’s inherent vulnerability to the adverse structural issues within its agricultural sector, robust and sustainable financing mechanisms are paramount for building resilience and ensuring future food stability.

Green Buildings and Infrastructure: Green bonds also present an opportunity to finance urban housing and transport systems designed to reduce carbon footprints. However, the widespread adoption of Electric Vehicles (EVs) faces significant hurdles, primarily due to the shrinking middle class and prevailing affordability challenges across the continent. Similarly, the concept of green buildings has yet to gain substantial traction, as the immediate priority for many remains securing basic housing, often irrespective of sustainable design principles or material sourcing.

Waste Management and Recycling: Moreover, green bonds can facilitate the expansion of circular economy models, particularly through investments in waste-to-energy initiatives and recycling enterprises. This area represents a significant untapped opportunity, as African leadership has yet to fully harness the vast potential inherent in waste recycling for economic growth and environmental benefit.

Policy and Ecosystem Support

Governments and regional bodies have a pivotal role to play. Developing national green finance strategies, taxonomies, and regulatory frameworks is critical. The African Development Bank (AfDB), for example, has initiated programs to support green finance frameworks and capacity building across member states.

Challenges to Overcome

Despite the promise, several challenges remain:

- Lack of standardisation in green project classifications

- Insufficient data to measure environmental impact

- Low investor awareness within local markets

- High transaction costs and limited technical expertise

Addressing these challenges will require coordinated efforts among governments, private sector stakeholders, multilateral institutions, and civil society.

Conclusion

Green bonds represent a powerful tool for financing sustainable development in Africa. For emerging businesses, they offer more than capital, they offer legitimacy, visibility, and growth pathways aligned with the global green transition. As Africa intensifies efforts to combat climate change and achieve the SDGs, green bonds can become a cornerstone of the continent’s financial evolution. Now is the time to deepen the market, build supportive ecosystems, and unlock the full potential of green financing for Africa’s future.